The Ultimate Guide to Investing in Stock Market 101: Tips for Success

Introduction to Investing in Stock

Investing in the stock market is one of the most powerful ways to build wealth over time. By purchasing shares of companies, you gain ownership in those businesses and can potentially profit from their growth. As an investor, your goal is to make informed decisions, maximize returns, and minimize risks. Using platforms like 5starsstocks, you can make smarter investment choices by accessing a wide array of tools, expert insights, and real-time data to help guide your investment journey.

Benefits of Investing in Stock Market

The stock market offers various advantages that can help you achieve long-term financial goals. Let’s dive into the key benefits:

- Potential for Appreciation: Stocks have historically delivered higher returns compared to other asset classes. As companies grow and become more profitable, the value of their stock often appreciates. With 5starsstocks, you can identify promising companies that are likely to experience growth.

- Cash Flow: Certain stocks, like dividend-paying ones, provide consistent cash flow to investors. By reinvesting dividends, you can leverage the power of compounding to increase your investment over time.

- Leverage: With margin accounts, you can borrow money to invest more than you would otherwise be able to, potentially amplifying returns (and risks). Make sure to evaluate your risk tolerance before using leverage.

- Tax Benefits: Stock market investments offer tax advantages in some countries, such as capital gains tax rates that may be lower than regular income tax rates. Using tax-efficient strategies with platforms like 5starsstocks can help you reduce your tax liability.

- Portfolio Diversification: The stock market allows for easy diversification across sectors, industries, and geographical regions, helping you spread risk. Diversifying your portfolio can stabilize your returns and protect you from market volatility.

Common Misconceptions about Stock Market Investing

Many people have misconceptions about stock market investing that can prevent them from getting started. Let’s clear some of these up:

- Stock Market Investing Requires a Lot of Money: While it’s true that some investments may require significant capital, you can start investing with smaller amounts. Platforms like 5starsstocks allow you to begin with minimal investment, helping beginners gradually grow their portfolios.

- Stock Market Investing is Too Risky: Like any investment, stocks carry risk. However, the risk can be mitigated through careful research, diversification, and long-term planning. 5starsstocks helps by providing expert insights and real-time data to help you make smarter decisions.

- Stock Market Investing is Too Time-Consuming: While some investors may spend hours monitoring their stocks, you don’t need to be constantly involved. By using automated features on platforms like 5starsstocks, you can set your strategy and let the system help you with ongoing management.

Types of Stock Market Investments

There are many different investment types in the stock market. Here are the most common:

- Stocks (Equities): Stocks represent ownership in a company. Investors purchase shares, hoping the value of the company grows over time. The more shares you own, the greater your ownership.

- Bonds: Bonds are debt securities issued by companies or governments. Bondholders receive periodic interest payments and the return of their principal when the bond matures.

- Mutual Funds: These funds pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. They offer diversification without requiring you to choose individual investments.

- Exchange-Traded Funds (ETFs): Like mutual funds, ETFs are collections of stocks, bonds, or other assets. However, they trade on the stock exchange like individual stocks, offering more flexibility and liquidity.

- Real Estate Investment Trusts (REITs): REITs allow you to invest in real estate without owning property directly. They provide exposure to real estate markets and offer the potential for regular income through dividends.

- Alternative Investments: These include investments outside traditional stocks and bonds, such as commodities, hedge funds, or private equity. They can offer diversification but may carry higher risks.

- Derivatives (Options and Futures): Derivatives are contracts whose value is derived from the price of an underlying asset. These are generally more complex and can offer high returns, but also higher risk.

- Commodities: Commodities like gold, oil, and agricultural products are physical assets that investors can trade. They can act as a hedge against inflation and market volatility.

Steps to Start Investing in Stock Market

If you’re new to stock market investing, follow these steps to get started:

- Define Your Investment Goals: Decide what you’re investing for (retirement, wealth building, etc.) and set clear, measurable goals.

- Evaluate Your Financial Situation: Assess your finances, including income, savings, and debts. Ensure you have enough to invest without compromising your daily needs.

- Educate Yourself: Learn the basics of investing, such as types of stocks, market analysis, and risk management. Platforms like 5starsstocks provide educational resources to help you understand key concepts.

- Develop Your Investment Strategy: Decide on your investment approach. Will you be an active or passive investor? What is your risk tolerance?

- Start Small and Diversify: Begin with a small investment, and diversify your portfolio across different asset classes. This helps mitigate risk and grow your investment steadily.

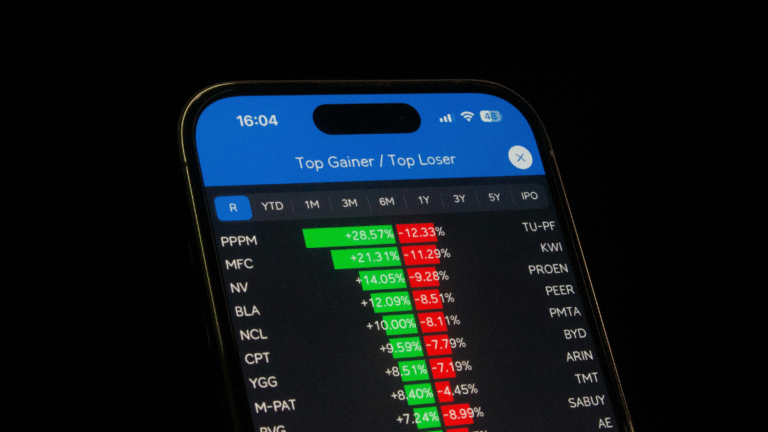

Researching the Stock Market

Before investing, thorough research is essential. Study company performance, market trends, and economic factors. Use tools like 5starsstocks to analyze data, review expert opinions, and make informed decisions. Researching allows you to identify opportunities with strong potential for growth and avoid risky investments.

Financing Options for Stock Market Investments

There are several ways to finance your stock market investments:

- Personal Savings: The most straightforward way to invest is by using your savings. Start with an amount you can afford to lose without affecting your financial stability.

- Margin Accounts: You can borrow funds from your brokerage to invest more than you would otherwise. While this amplifies returns, it also increases risk, so use caution.

- Retirement Accounts: Consider using tax-advantaged retirement accounts like IRAs or 401(k)s, which allow you to invest in stocks and defer taxes until retirement.

Tips for Finding Profitable Stocks

To identify profitable stocks, follow these tips:

- Look for Strong Financials: Check key indicators like earnings growth, debt levels, and return on equity.

- Follow Industry Trends: Some industries perform better in certain economic climates. Use tools from 5starsstocks to track industry performance.

- Diversify: Invest in a range of sectors to protect your portfolio from market fluctuations.

Managing and Maintaining Stock Investments

Managing stock investments involves regular monitoring, rebalancing, and reviewing your strategy. Keep track of your portfolio’s performance, make adjustments based on market conditions, and stay updated with relevant news. 5starsstocks offers portfolio management tools to help you stay on top of your investments.

Stock Market Investment Resources and Tools

To succeed in the stock market, utilize various resources and tools, including:

- Online Brokerages: Choose a brokerage like 5starsstocks that offers low fees, educational resources, and powerful tools to help you track and manage your investments.

- Financial News and Research: Stay informed with reliable financial news sources and stock analysis platforms.

- Investment Apps: Use apps that track your investments and help with strategy execution, portfolio analysis, and tax management.

Final Remarks

Investing in the stock market can be a lucrative way to build wealth, but it requires education, strategy, and patience. Platforms like 5starsstocks empower investors with the tools, insights, and support needed to make informed decisions. Start small, stay educated, and remember that successful investing is a marathon, not a sprint.

3 Comments