How to Invest in European Defense Stocks

Investing in European defense stocks has become an intriguing opportunity for many investors due to shifting geopolitical landscapes and increasing defense expenditures. This blog post will guide you step-by-step on why and how to invest in European defense stocks with a focus on key industry insights, companies, and investment strategies.

Why European Defense Stocks Are Gaining Attention

European defense stocks are attracting growing interest from investors around the world. Heightened geopolitical tensions, increased government defense spending, and advancements in military technology have positioned these stocks as potential avenues for long-term growth. As global security concerns escalate, companies within the European defense sector are benefiting from robust order books and increased government contracts.

Understanding the European Defense Industry

The European defense industry is a critical component of global security, driven by established companies and influenced heavily by NATO and the European Union’s defense policies. Key players include giants like BAE Systems, Airbus, Leonardo, Rheinmetall, and Thales, who develop advanced defense equipment and services. NATO and EU policies shape defense spending priorities and drive collaboration across member states, adding stability and growth prospects for these companies.

Why Consider Investing in Defense Stocks?

Investing in European defense stocks is appealing for several reasons:

-

Geopolitical tensions: Rising conflicts and uncertainties increase defense spending globally, benefiting defense firms.

-

Increased defense budgets: European countries are committing more funds to modernize their military capabilities, directly impacting defense stock valuations.

-

Long-term growth prospects: The need for cutting-edge technologies ensures sustained demand, offering investors attractive long-term returns.

Major European Defense Companies to Watch

| Company | Description | Headquarters |

|---|---|---|

| BAE Systems | Leading defense contractor specializing in aerospace and security | United Kingdom |

| Airbus | Aerospace giant with strong defense division | France |

| Leonardo | Italian company focused on aerospace, defense, and security | Italy |

| Rheinmetall | German firm specializing in automotive and defense technology | Germany |

| Thales | French multinational focusing on defense, aerospace, and security | France |

-

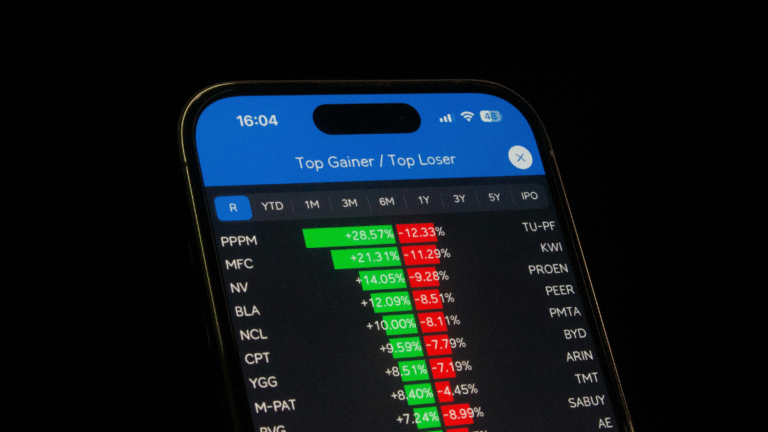

Direct stock purchases: Buying shares of individual companies like BAE Systems or Airbus through a brokerage allows you to target specific leaders in the sector.

-

Exchange-Traded Funds (ETFs): ETFs focused on defense or aerospace offer diversified exposure to European defense stocks with reduced risk.

-

Mutual funds and index funds: Some funds include defense companies in their portfolios, suitable for investors seeking professional management.

Factors to Consider Before Investing

-

Market risks: Defense stocks can be sensitive to political developments and budgeting decisions.

-

Ethical concerns: Some investors may have reservations about profiting from military activities.

-

Government regulations: Defense companies operate under stringent rules; changes can significantly impact profitability.

Risks and Challenges in Defense Stock Investments

-

Political uncertainty: Changes in government policies or international relations can affect contracts and stock prices.

-

Contract dependencies: Reliance on a few large defense contracts can pose risks if these are delayed or canceled.

-

Industry competition: The sector is competitive, with constant innovation required to stay relevant.

Investment Strategies for Defense Stocks

-

Long-term vs. short-term approach: Long-term investing can capture growth from technological advancements, while short-term trading might exploit market movements.

-

Diversification with other sectors: Combining defense stocks with other industries helps manage risk.

-

Dividend opportunities: Many European defense companies offer dividends, providing steady income alongside capital growth.

The Future Outlook of the European Defense Sector

Technology is reshaping this sector, with artificial intelligence, drones, and cybersecurity becoming critical focus areas. Furthermore, growing defense collaboration within the EU is expected to streamline procurement and boost innovation, enhancing the sector’s future potential.

Conclusion: Is Investing in European Defense Stocks Right for You?

European defense stocks offer unique opportunities influenced by global security dynamics and technological advancement. If you seek long-term growth, are comfortable navigating geopolitical risks, and align ethically with the sector, investing in European defense stocks can be a valuable addition to your portfolio. Careful research and strategic planning will enhance your chances of success in this dynamic market.

One Comment