How to Invest in EU Defense Stocks

Investing in EU defense stocks presents an opportunity to be part of a critical sector that supports the security and technological strength of Europe. The defense industry in the European Union (EU) encompasses a wide range of companies involved in aerospace, cybersecurity, weapons manufacturing, and more. Understanding how to invest in EU defense stocks means tapping into a market shaped by geopolitical concerns, government spending, and cutting-edge innovation.

Why defense stocks matter in Europe

Defense stocks matter in Europe because the continent faces evolving security challenges that prompt countries to increase military budgets and modernize their forces. Defense companies play a vital role in ensuring national safety while driving innovation in areas like cyber defense and advanced weaponry. These firms often benefit from long-term government contracts, making their stocks a strategic investment.

Current trends in the EU defense sector

The current trends in the EU defense sector include significant increases in defense spending, accelerated development of new military technologies, and a focus on collaborative European defense initiatives such as the Readiness 2030 plan. Countries like Germany, France, and Poland are investing heavily to shore up defenses and reduce reliance on external partners. This momentum is pushing defense stocks higher as investors seek to capitalize on sustained growth and government backing.

Why Consider Investing in Defense Stocks?

Rising geopolitical tensions

With rising geopolitical tensions in regions near Europe and evolving threats such as cyber-attacks and hybrid warfare, the demand for defense solutions is growing. Such tensions often prompt greater military spending, which can boost defense companies’ revenues and stock valuations.

Government defense spending in the EU

EU governments are committed to increasing defense budgets, with many meeting or exceeding the NATO guideline of 2% of GDP. The European Commission’s strategic initiatives, like Readiness 2030, encourage member states to spend more efficiently and collaboratively, creating opportunities for defense firms to secure substantial contracts.

Long-term growth potential

Investing in EU defense stocks offers long-term growth potential driven by ongoing government support, technological innovation, and shifting security priorities. Unlike some sectors, defense tends to be less cyclical, providing investors with a degree of stability alongside the potential for capital appreciation.

Understanding the EU Defense Industry

The EU defense industry covers several key sectors including aerospace (military aircraft and helicopters), cybersecurity (protection against digital threats), weapons manufacturing (arms and ammunition), and defense electronics (radar and communication systems). Major European defense programs and initiatives aim to foster collaboration and innovation across member states to maintain Europe’s strategic autonomy and readiness.

Related Post:

Top EU Defense Companies to Watch

| Company | Country | Specialization |

| Airbus | France/Germany | Military aircraft, helicopters |

| BAE Systems | United Kingdom | Combat vehicles, cyber defense |

| Leonardo S.p.A | Italy | Avionics, helicopters, naval defense |

| Thales Group | France | Electronics, cybersecurity |

| Rheinmetall | Germany | Armored vehicles, weapons systems |

How to Invest in EU Defense Stocks

Buying individual stocks

One way to invest is by purchasing shares of individual EU defense companies. This approach allows investors to focus on firms they believe have the best growth prospects, but it also involves higher risk due to less diversification.

Investing through ETFs or mutual funds

For diversified exposure, investors can choose ETFs or mutual funds that focus on European defense stocks. These funds bundle multiple companies, reducing risk and offering a balanced investment across the sector.

Diversification strategies

Diversification is key when investing in defense stocks. Incorporating stocks from various defense sub-sectors, or combining individual stocks with ETFs, helps mitigate risks from company-specific issues or regulatory changes.

Risks of Investing in Defense Stocks

Political and regulatory risks

Defense companies are heavily influenced by government policies, international relations, and regulatory environments. Changes in defense budgets or diplomatic tensions can impact stock performance.

Ethical concerns

Some investors may have ethical reservations about investing in defense stocks due to the industry’s involvement in warfare and weapons manufacturing, which may not align with personal values.

Market volatility

Like all stocks, defense shares can be subject to market volatility. Factors such as geopolitical developments or sudden policy shifts can cause price fluctuations.

Factors to Consider Before Investing

Research and due diligence

Careful research is essential. Investors should analyze company financials, contract pipelines, and geopolitical contexts before committing capital to EU defense stocks.

Monitoring EU defense budgets

Tracking defense budget announcements and EU defense initiatives helps investors anticipate potential growth areas within the sector.

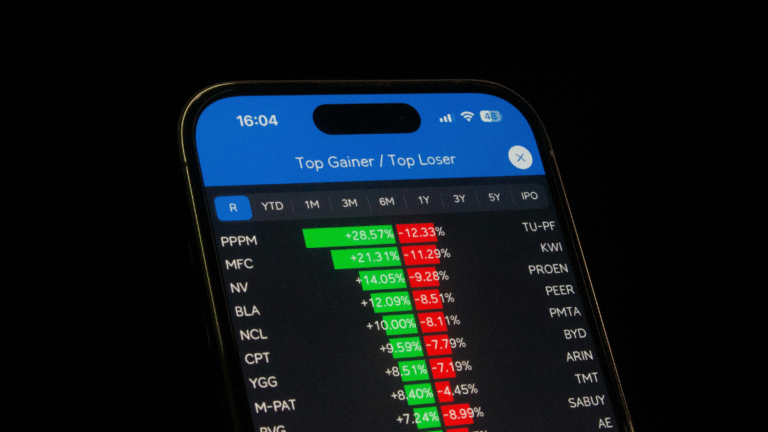

Analyzing stock performance

Examining historical and projected stock performance, along with valuation metrics, aids in selecting companies or funds with strong investment potential.

Best Platforms to Buy EU Defense Stocks

Online brokers available in the EU

Numerous online brokers in the EU offer access to defense stocks, including platforms like DEGIRO, Interactive Brokers, and eToro, providing user-friendly interfaces and competitive fees.

Global trading platforms for international investors

International investors looking to buy EU defense stocks can utilize global trading platforms such as TD Ameritrade or Charles Schwab, which provide access to European exchanges and ADRs (American Depositary Receipts).

Future Outlook for the EU Defense Market

Impact of NATO and EU defense policies

NATO’s increased defense spending goals and EU policies like Readiness 2030 will shape defense industry growth by promoting greater cooperation and investment in new capabilities.

Role of technology and innovation

Advanced technologies such as artificial intelligence, autonomous systems, and cybersecurity solutions are poised to drive the next wave of growth in EU defense stocks.

Growth predictions

Industry forecasts predict steady growth fueled by expanded budgets, modernization programs, and emerging security challenges, making EU defense stocks a promising area for investors.

Conclusion

How to invest in EU defense stocks is a question that combines strategy, awareness of geopolitical dynamics, and understanding industry fundamentals. With rising defense budgets, long-term government contracts, and innovation at its core, the EU defense sector offers unique investment opportunities. Whether through individual stocks or ETFs, investors can position themselves to benefit from Europe’s commitment to enhancing its security and technological capabilities.

One Comment