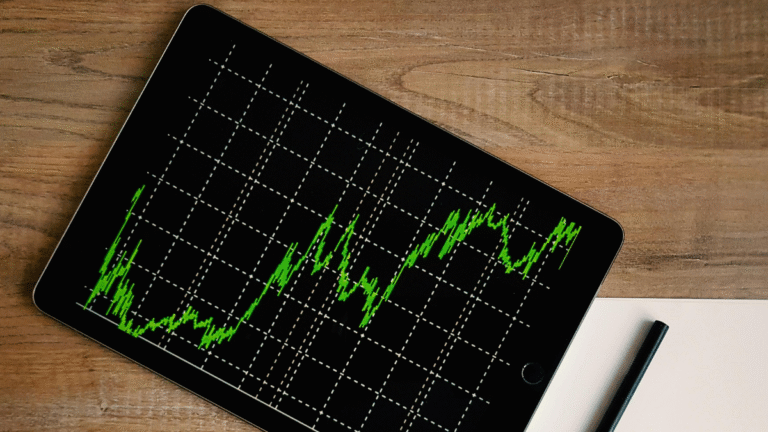

How to Invest in Casino Stocks

Why Casino Stocks Are Gaining Attention

Casino stocks have become increasingly popular among investors due to the industry’s dynamic growth and evolving landscape. With the rise of online gambling and technological innovations, casino companies are attracting significant market interest. Investing in casino stocks offers potential for substantial returns as the sector expands both through traditional venues and digital platforms.

Understanding the Casino Industry and Its Revenue Streams

The casino industry generates revenue from various sources including gaming operations, hotel accommodations, entertainment events, food and beverage services, and online betting platforms. Land-based casinos rely heavily on visitor foot traffic and tourism, while online gambling sites focus on digital user engagement. Understanding these diverse revenue streams helps investors gauge stability and growth potential within casino stocks.

Types of Casino Stocks You Can Invest In

- Land-based casino operators: These companies own and operate physical casinos and resorts. Their profits depend on location, tourism trends, and local regulations.

- Online gambling platforms: This segment includes businesses offering internet-based betting, poker, sports betting, and casino games, benefiting from broader accessibility and technological innovation.

- Casino suppliers and technology providers: These firms supply gaming machines, software, and technology solutions like payment systems, AI, and VR experiences that support casino operations both on-site and online.

Key Factors to Analyze Before Investing

- Market demand and tourism: The volume of visitors to casino locations and the popularity of online gambling affect revenue and stock performance.

- Regulatory environment: Gambling laws and regulations vary by region and can impact profitability and business operations.

- Financial performance of casino companies: Reviewing earnings reports, debt levels, and cash flow offers insights into company stability and growth.

- Competition and global trends: Investors should consider how casinos compete locally and globally, including emerging market expansions and tech adoption.

Top Casino Stocks to Watch in 2025

| Company Name | Market Cap | Segment | Recent Performance (%) | Dividend Yield |

| Las Vegas Sands | $35B | Land-based operators | +12 | 3.5% |

| DraftKings | $8B | Online platforms | +25 | N/A |

| Evolution Gaming | $15B | Technology providers | +18 | 1.2% |

| MGM Resorts | $20B | Land-based operators | +10 | 2.8% |

| Flutter Entertainment | $12B | Online platforms | +22 | 1.5% |

Risks Involved in Investing in Casino Stocks

- Legal restrictions: Changes in laws or stricter gambling regulations can limit operations or impose fines.

- Economic downturns: Casinos are often sensitive to recessions since discretionary spending declines.

- Social and ethical concerns: Negative public perception of gambling addiction and social harm may impact long-term growth.

Strategies for Investing in Casino Stocks

- Long-term vs. short-term investments: Long-term investors might focus on established casino operators, while short-term traders may seek opportunities in volatile online platform stocks.

- Diversifying with ETFs and mutual funds: Funds grouped around gaming or entertainment sectors help reduce risk.

- Dividend-paying casino stocks: Some casino companies offer dividends, providing income alongside potential stock appreciation.

Global Trends Shaping the Casino Industry

- Online gambling growth: The shift towards mobile and web-based gambling continues to drive revenue expansion globally.

- Expansion in Asia and emerging markets: Countries like China and Southeast Asia are seeing increased casino development due to rising tourism.

Integration of technology

| Technology | Impact on Casino Industry |

| AI | Personalized gaming experiences and fraud detection |

| Blockchain | Secure payments and transparent betting systems |

| Virtual Reality | Immersive casino environments attracting younger players |

Tips for Beginner Investors in Casino Stocks

Start by researching companies thoroughly, focusing on their financial health and market position. Consider begin with smaller investments or casino-focused ETFs to manage risk. Stay updated on regulatory news and technology trends as these heavily influence casino stock performance.

Conclusion: Is Investing in Casino Stocks Right for You?

Investing in casino stocks can offer attractive growth opportunities, especially with the rise of online gambling and new technologies. However, potential investors should weigh the risks from legal, economic, and social factors carefully. With informed research and strategic diversification, casino stocks can be a valuable addition to a balanced investment portfolio.