3D Printing Stocks 101: A Beginner’s Guide to Smart Investing

The world of investing is constantly evolving, and technology-driven industries often hold the key to future growth. One such sector is 3D printing, a field that has been making waves across manufacturing, healthcare, aerospace, and even consumer goods. For beginner investors, 3d printing stocks could be an exciting entry point into a fast-growing industry with remarkable potential. This guide will walk you through what these stocks are, their benefits, risks, and how to identify the right opportunities for smart investing.

What are 3D Printing Stocks?

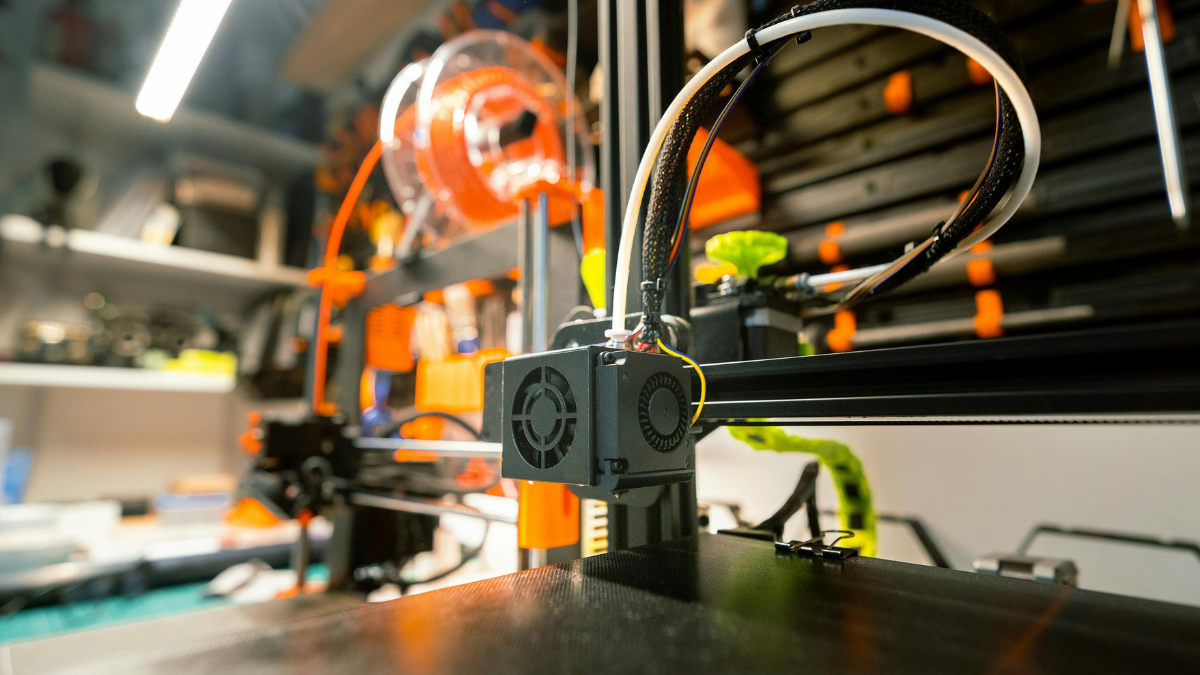

Definition and Key Characteristics

3D printing stocks are shares of companies involved in the design, manufacturing, or distribution of 3D printing technologies and services. These may include firms that produce 3D printers, suppliers of printing materials, or businesses leveraging 3D printing to streamline production. The key characteristics of 3d printing stocks are innovation-driven growth, reliance on research and development, and exposure to industries adopting advanced printing technologies.

Examples of 3D Printing Stocks

Some notable players in the 3D printing space include companies like 3D Systems, Stratasys, and Proto Labs. Larger corporations such as HP and GE have also invested heavily in additive manufacturing, making them indirect options for investors interested in 3d printing stocks.

Benefits of Investing in 3D Printing Stocks

Potential for Long-term Gains

3D printing is transforming how products are created, reducing costs, shortening lead times, and enabling custom manufacturing. As industries adopt this technology on a global scale, the demand for 3D printing equipment and services is expected to rise. This long-term adoption curve makes 3d printing stocks potentially rewarding for patient investors.

Lower Prices and Higher Dividends

Compared to heavily saturated sectors like traditional technology or finance, 3d printing stocks may often trade at lower entry prices. Some mature companies in this sector also offer dividends, giving investors a chance to benefit from both stock appreciation and steady income over time.

Risks and Limitations of 3D Printing Stocks

Difficulty in Accurately Determining Value

Valuing 3d printing stocks can be challenging. Many companies are still in the growth stage, with revenues that fluctuate based on research breakthroughs or large-scale contracts. This uncertainty makes it harder to predict future financial performance.

Possible Underperformance During Economic Growth

Interestingly, 3d printing stocks might not perform well during all phases of economic cycles. For instance, in times of broad economic expansion, traditional manufacturing companies may outpace 3D printing firms due to established infrastructure and higher demand, creating periods of underperformance for the sector.

How to Identify 3D Printing Stocks

Key Financial Metrics

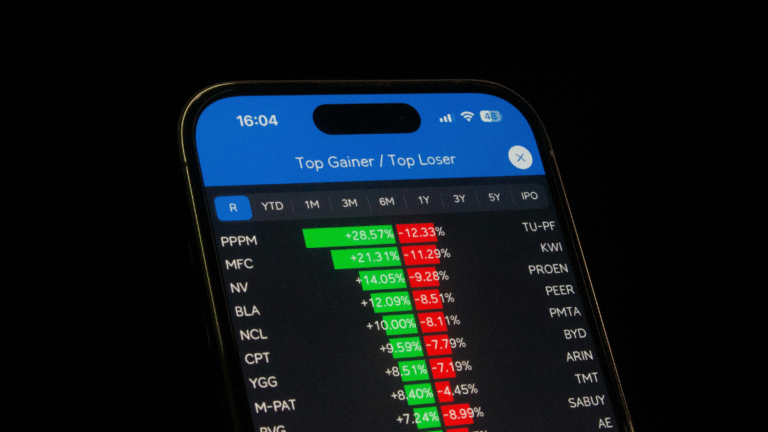

When evaluating 3d printing stocks, investors should pay attention to core financial indicators such as revenue growth, profit margins, R&D expenditure, and debt levels. A company actively reinvesting into innovation while maintaining financial stability stands out as a stronger candidate.

Using Financial Tools and Resources

Resources like stock screeners, industry analysis reports, and earnings calls can help investors assess the potential of 3d printing stocks. Monitoring global adoption trends, patents filed by companies, and partnerships within the sector can further guide smarter investment decisions.

Conclusion

Investing in 3d printing stocks offers a chance to tap into a cutting-edge industry that is reshaping global manufacturing. While the sector comes with risks such as valuation challenges and fluctuating performance, its long-term potential remains appealing. By studying key metrics and leveraging financial tools, beginner investors can position themselves wisely in this dynamic market.

FAQs

Q1: Are 3D printing stocks a safe investment?

No investment is completely risk-free. 3d printing stocks carry volatility due to innovation cycles and market adoption rates, but they can be a good long-term play for diversified portfolios.

Q2: How much should I invest in 3D printing stocks as a beginner?

It’s best to start small and focus on diversification. Don’t put all your capital into one emerging sector. Treat 3d printing stocks as part of a balanced investment portfolio.

Q3: Which industries drive demand for 3D printing?

Key industries include aerospace, automotive, healthcare, construction, and consumer products, all of which contribute to the growth and demand for 3d printing stocks.

Q4: Can I buy 3D printing stocks through ETFs?

Yes. Several ETFs focus on additive manufacturing and related technologies, offering beginners a safer way to gain exposure to multiple 3d printing stocks at once.

3 Comments